You are here:Chùa Bình Long – Phan Thiết > crypto

Bitcoin Wallet Wealth Distribution: An Analysis of the Digital Currency Landscape

Chùa Bình Long – Phan Thiết2024-09-21 22:30:59【crypto】4people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, Bitcoin has emerged as a revolutionary digital currency that has captured the atten airdrop,dex,cex,markets,trade value chart,buy,In recent years, Bitcoin has emerged as a revolutionary digital currency that has captured the atten

In recent years, Bitcoin has emerged as a revolutionary digital currency that has captured the attention of investors and enthusiasts worldwide. As the popularity of Bitcoin continues to soar, so does the wealth accumulated within Bitcoin wallets. This article delves into the fascinating world of Bitcoin wallet wealth distribution, exploring the disparities and trends within the digital currency landscape.

Bitcoin wallet wealth distribution refers to the distribution of Bitcoin holdings across various wallets. This distribution can be categorized into different segments, including individual wallets, institutional investors, and exchanges. Understanding the dynamics of Bitcoin wallet wealth distribution is crucial for investors and policymakers alike, as it provides insights into the market's structure and potential risks.

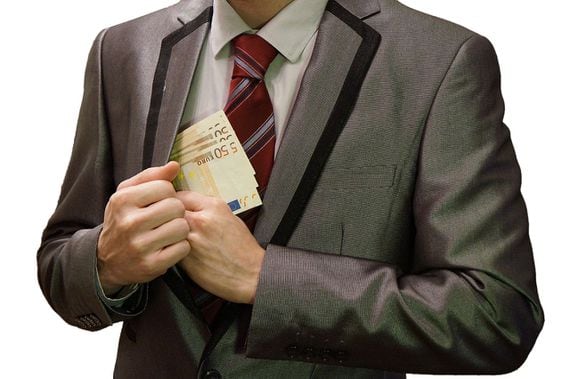

One of the most striking aspects of Bitcoin wallet wealth distribution is the concentration of wealth within a small number of wallets. According to a report by Chainalysis, the top 1% of Bitcoin wallets hold approximately 40% of the total Bitcoin supply. This concentration of wealth raises questions about the market's stability and the potential for manipulation.

The reasons behind this concentration of wealth can be attributed to several factors. Firstly, Bitcoin's finite supply of 21 million coins has created a sense of scarcity, attracting high-net-worth individuals and institutional investors who are willing to invest substantial amounts in the digital currency. Secondly, the volatile nature of Bitcoin has made it a popular asset for speculative trading, further contributing to the concentration of wealth.

Another interesting trend in Bitcoin wallet wealth distribution is the increasing share of institutional investors. Over the years, institutional investors have shown a growing interest in Bitcoin, with many of them allocating a portion of their portfolios to the digital currency. This trend has been further accelerated by the launch of Bitcoin exchange-traded funds (ETFs) and other financial products that make it easier for institutional investors to gain exposure to Bitcoin.

While the concentration of wealth within a few wallets may seem concerning, it is important to note that Bitcoin's decentralized nature ensures that the wealth distribution is not controlled by a single entity. The digital currency's peer-to-peer network allows for a more democratized wealth distribution, as anyone with an internet connection can participate in the Bitcoin ecosystem.

However, the wealth distribution within Bitcoin wallets is not uniform across different regions. For instance, the United States and China have been at the forefront of Bitcoin adoption, with a significant portion of Bitcoin wealth concentrated in these countries. This regional disparity can be attributed to various factors, including regulatory frameworks, technological infrastructure, and cultural attitudes towards digital currencies.

In conclusion, Bitcoin wallet wealth distribution is a complex and dynamic aspect of the digital currency landscape. The concentration of wealth within a few wallets raises concerns about market stability, while the increasing participation of institutional investors and the democratized nature of Bitcoin ensure a more balanced and inclusive ecosystem. As Bitcoin continues to evolve, it is crucial for investors and policymakers to monitor and understand the wealth distribution dynamics to make informed decisions and promote a healthy and sustainable digital currency market.

This article address:https://www.binhlongphanthiet.com/crypto/87b6199851.html

Like!(245)

Related Posts

- Binance App QR Scanner: A Game-Changer for Cryptocurrency Transactions

- Bitcoin Wallet Nederland: The Ultimate Guide to Secure Cryptocurrency Storage

- **Transforming TRX to BTC on Binance: A Comprehensive Guide

- Live Updating Bitcoin Price: The Real-Time Pulse of Cryptocurrency Markets

- How to Make a Physical Bitcoin Wallet: A Step-by-Step Guide

- Can I Use Solar Power to Mine Bitcoin?

- Can I Mine My Own Bitcoin?

- How to Open Old Bitcoin Wallet: A Comprehensive Guide

- NVIDIA Mining Bitcoin: A Game Changer in Cryptocurrency Mining

- **Americas Card Room Bitcoin Wallet: A Secure and Convenient Solution for Online Poker Players

Popular

Recent

The World's Single Biggest Bitcoin Wallet: A Treasure Trove of Cryptocurrency

How Much Do You Need to Start Mining Bitcoin?

What is the Highest Price of Bitcoin?

**The Evolution of Mining MHS Bitcoin: A Journey into Cryptocurrency's Heartbeat

How to Find New Listing on Binance: A Comprehensive Guide

**Americas Card Room Bitcoin Wallet: A Secure and Convenient Solution for Online Poker Players

Binance Wallet Problem: A Comprehensive Analysis

**Finding a Legit Free Bitcoin Mining Site: A Comprehensive Guide

links

- Coinbase Bitcoin Cash Free: A Game-Changer for Cryptocurrency Users

- **The Importance of Encrypting Your Bitcoin Wallet

- Bitcoin Mining Hardware for Sale on Alibaba: A Comprehensive Guide

- The Most Effective Methods of Mining Bitcoin

- Is Binance Smart Chain on Ethereum?

- The Rise of Server Mining Bitcoin Mod: A Game-Changer for Crypto Enthusiasts

- Bitcoin Testnet Wallet iPhone: A Comprehensive Guide

- Bitcoin Cash Vote: A Milestone in the Cryptocurrency World

- Best Free Bitcoin Mining: Unleashing the Potential Without the Cost

- Reddit Binance Coin Burn: A Game-Changing Move in the Cryptocurrency World